|

What's a Credit Card Balance Transfer?

A balance transfer is simple. You apply for a new card with a lower interest rate than your current card. Then, you request to transfer your balance from that card to the new one. Essentially, you're moving credit card debt from one credit card to another to save money on interest. Do you carry balances on multiple credit cards? You can transfer multiple balances to a Cedar Point credit card for a simpler monthly payment.

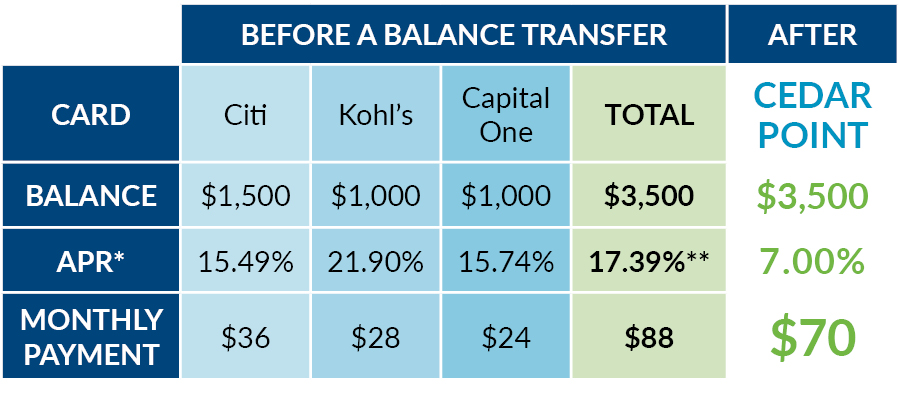

When you transfer your balances to a Cedar Point credit card, you can consolidate your debt while also accessing a lower, fixed rate. Lower rates can potentially help you save money on your monthly payments and pay off your debt sooner. Here's how:

- Make it simple: Turn multiple payments into one payment.

- Lock in a low rate: Cedar Point offers consistently low rates.

- Fixed-rate: There is no penalty rate or variable rate.

- Pay it down: With a lower rate, you can pay down debt faster.

- No balance transfer fee: You can concentrate on saving.

Here's an example of what your monthly interest savings might look like if you transfer your balances to Cedar Point. In the scenario below, your monthly payment would be reduced by $18. Over time, those savings really add up.

*APR = Annual Percentage Rate

**Weighted Average

Do the Math

If you carry a balance, with an APR of between 15 – 20%, almost half of every minimum payment made is consumed by interest charges. With over 20% APR that becomes nearly two-thirds of your minimum payment. The example below reflects a $1,000 balance. If you carry a balance, with an APR of between 15 – 20%, almost half of every minimum payment made is consumed by interest charges. With over 20% APR that becomes nearly two-thirds of your minimum payment. The example below reflects a $1,000 balance.

If your minimum payment is $25 on your $1,000 balance:

- At 15% APR, you will pay $12.50 of the $25.00 in interest alone. Exactly half of your minimum payment is committed to paying off accrued interest.

- At 20% APR, you will pay $16.67 of the $25.00 in interest. Here, you'll only be paying down $8.33 of principal.

- At 22% APR (which is a common APR for many reward credit cards), you'll be paying $18.33 in interest charges.

You get the idea. With a lower rate like 7%, you are paying more toward the principal to help you decrease your debt faster.

Which Credit Card is Right for You?

| | Platinum |

Gold

| Classic |

|---|

| |

|

|

|

| Apply for a Mastercard |

APPLY NOW |

| APR for Purchases |

8.00% |

9.00% |

10.90 - 12.90*% |

| APR for Cash advances |

8.00% |

9.00%

|

10.90 - 12.90*%

|

|

Annual Fee

|

$0

|

$0

|

$0

|

|

Balance Transfer Fee

|

None

|

None

|

None

|

|

Credit Limit

|

Up to $25,000

|

Up to $15,000

|

Up to $5,000

|

|

Fixed Rate

|

x |

x |

x |

| Penalty Rate |

None |

None |

None |

| Over the Credit Limit Penalty |

None |

None |

None |

| Foreign Transaction Fee |

1% of each transaction in US dollars

|

| Late Payment Penalty |

$15.00. Your due date is at least 25 days after the close of each billing cycle. We will not charge you any interest on purchases if you pay your entire balance by the due date each month.

|

| Returned Payment Penalty |

$20.00

|

| |

*When you open your account, based on creditworthiness.

Rates are fixed. Rate information is accurate as of February 5, 2024.

All rates are subject to change. Rate information is as accurate as possible. However, please contact the credit union to verify current rates or if you would like a disclosure mailed to you.

|

| |

Read the Mastercard Account Agreement

Read the Mastercard Billing Notice

|

| |

Get helpful tips from the Consumer Financial Protection Bureau

|

|